XPO LOGISTICS, INC.

Five American Lane

Greenwich, Connecticut 06831

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

|

To Be Held on May 17, 201811, 2021

To the stockholdersStockholders of XPO Logistics, Inc.:

Notice is hereby given that the annual meeting2021 Annual Meeting of stockholdersStockholders (the "Annual Meeting") of XPO Logistics, Inc. ("XPO" or the "company") will be held on Thursday,Tuesday, May 17, 201811, 2021 at 10:00 a.m. Eastern Daylight TimeTime. The meeting will be conducted as a webcast due to the public health concerns related to COVID-19. You can access the meeting at Doral Arrowwood, 975 Anderson Hill Road, Rye Brook, NY 10573www.meetingcenter.io/260352583 with password XPO2021 and a control number that will be issued to you upon request. Please follow the instructions on page 8 of the Proxy Statement to request your control number.

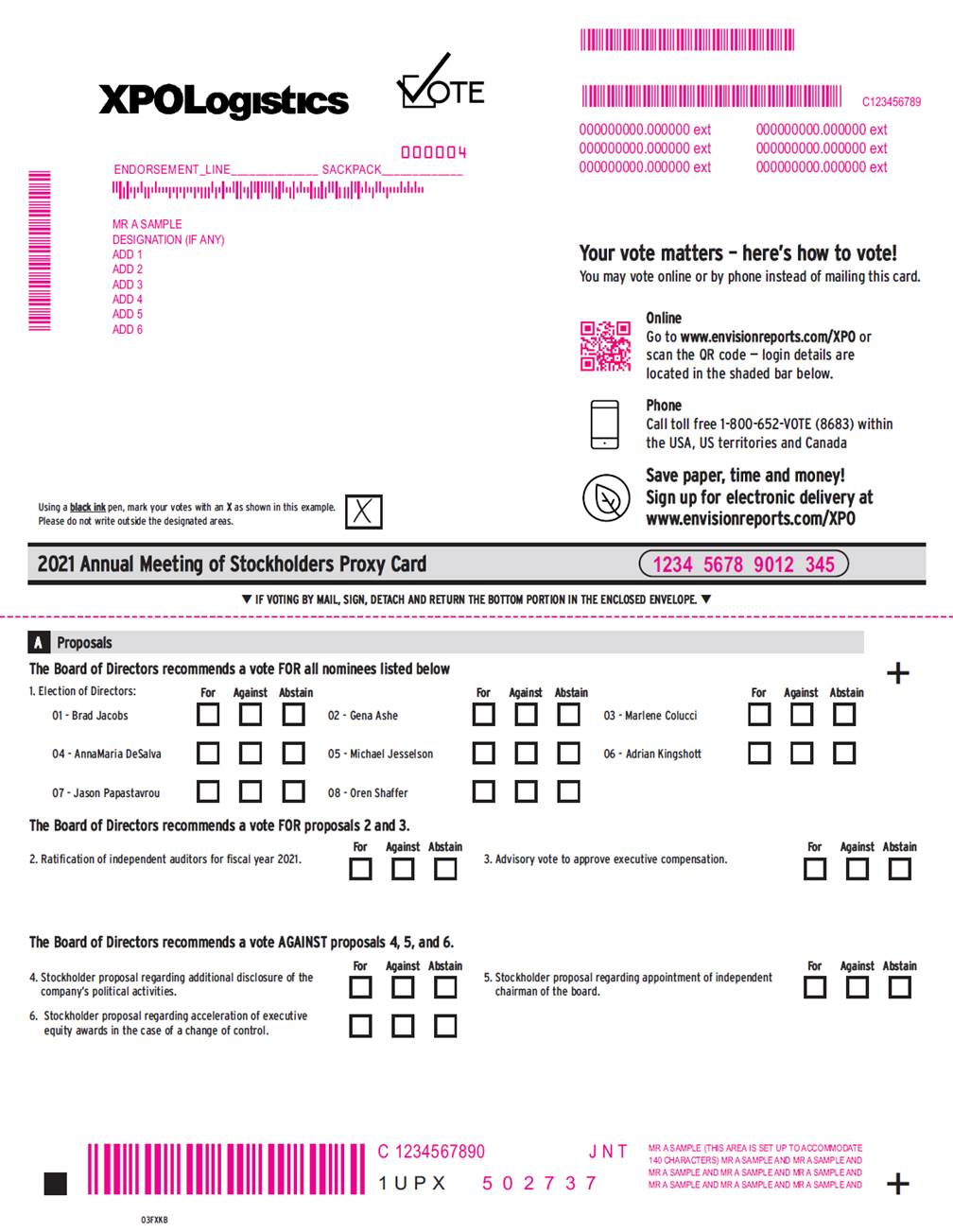

The Annual Meeting shall be held for the following purposes assummarized below, and more fully described in the proxy statement:Proxy Statement accompanying this notice:

- ■

- To elect eight (8) members of our Board of Directors for a term to expire at the 2022 Annual Meeting of Stockholders or until their successors are duly elected and qualified;

- ■

- To ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2021;

- ■

- To conduct an advisory vote to approve the executive compensation of our named executive officers ("NEOs"), as disclosed in the Proxy Statement;

- ■

- To consider and act upon a stockholder proposal regarding additional disclosure of the company's political activities, if properly presented at the Annual Meeting;

- ■

- To consider and act upon a stockholder proposal regarding the requirement that the chairman of the board be an independent director, if properly presented at the Annual Meeting;

- ■

- To consider and act upon a stockholder proposal regarding the acceleration of executive equity awards in the case of a change in control of the company, if properly presented at the Annual Meeting; and

- ■

- To consider and transact other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

Only stockholders of record of our common stock, par value $0.001 per share, and our Series A Convertible Perpetual Preferred Stock, par value $0.001 per share, as of the close of business on April 6, 20188, 2021 are entitled to receive notice of, and to vote at, the annual meetingAnnual Meeting or any adjournment or postponement of the annual meeting.Annual Meeting.

Please note that if you plan to attend the annual meeting in person, you will need to register in advance and receive an admission ticket in order to be admitted. Please follow the instructions on pages4-8 of the proxy statement.

Your vote is important. Whether or not you plan to attend the annual meeting in person,Annual Meeting, it is important that your shares be represented. We ask that you vote your shares as soon as possible.

| By Order of the Board of Directors, | ||

| ||

Brad Jacobs Chairman and Chief Executive Officer | ||

Greenwich, Connecticut April 13, 2021 |

By Order of the Board of Directors,

Bradley S. Jacobs

Chairman and Chief Executive Officer

Greenwich, Connecticut

April 18, 2018

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to Be Held on May 17, 2018:11, 2021:

ThisThe Proxy Statement and our Annual Report on Form10-K for the Year Ended December 31, 2017

2020 are available atwww.edocumentview.com/XPO

| | |

| | ©2021 XPO Logistics, Inc. |

| | |

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to Be Held on May 17, 2018 :

This Proxy Statement and our Annual Report on Form10-K for the Year Ended December 31, 2017

are available atwww.edocumentview.com/XPO.

77 | ||

ANNEX A—RECONCILIATION OF NON-GAAP MEASURES | 78 | |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on May 11, 2021: | ||

This Proxy Statement and our Annual Report on Form 10-K for the Year Ended December 31, 2020 are available at www.edocumentview.com/XPO. |

| | |

| | ©2021 XPO Logistics, Inc. |

| | |

This proxy statementProxy Statement sets forth information relating to the solicitation of proxies by the Board of Directors (“Board(the "Board of Directors”Directors" or “Board”"Board") of XPO Logistics, Inc. in connection with our company’s 2018 annual meeting2021 Annual Meeting of stockholders.Stockholders. This summary highlights information contained elsewhere in this proxy statement.Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statementProxy Statement carefully before voting.

2018 Annual Meeting of Stockholders

Date and Time: May 17, 2018 at 10:00 a.m. Eastern Daylight Time

Place: Doral Arrowwood, 975 Anderson Hill Road, Rye Brook, NY 10573

Record Date: You can vote if you were a stockholder of record of our company as of the close of business on April 6, 2018 (the “Record Date”).

Admission:You will need an admission ticket to enter the annual meeting. You may request an admission ticket by providing the name under which you hold shares of record or, if your shares are held in the name of a bank, broker or other holder of record, the evidence of your beneficial ownership of the shares, the number of admission tickets you are requesting and your contact information. No cameras, mobile phones or other electronic or recording devices will be allowed to be used in the meeting room.

2021 ANNUAL MEETING OF STOCKHOLDERS This Admission: You will not be able to attend the Annual Meeting in person this year. You can access the Annual Meeting at www.meetingcenter.io/260352583 with password XPO2021. You will need to provide the control number on your proxy card in order to access the Annual Meeting. If the shares of common stock you hold are in an account at a broker, dealer, commercial bank, trust company or other nominee (i.e., in "street name"), you must register in advance to participate in the Annual Meeting, vote electronically and submit questions during the live webcast of the meeting. To register in advance, you must obtain a legal proxy from the bank, broker or other nominee that holds your shares giving you the right to vote the shares. Requests for registration should be directed to our transfer agent, Computershare Trust Company, N.A. ("Computershare"), by email at legalproxy@computershare.com no later than 5:00 p.m. Eastern Time, on Thursday, May 6, VOTING MATTERS AND BOARD RECOMMENDATIONS The Board is not aware of any matter that will be presented for a vote at the Additional Disclosure of the Company's Political ActivitiesYou can submit your request by sending ane-mail tostockholdermeetings@xpo.com OR by calling us toll-free at (855)976-6951.proxy statementProxy Statement and form of proxy are first being mailed on or about April 18, 2018,13, 2021, to our stockholders of record as of the close of business on April 8, 2021 (the "Record Date").Date and Time Place Record Date ![]()

Tuesday, May 11, 2021

at 10:00 a.m. Eastern Time![]()

Virtual Meeting Site:

www.meetingcenter.io/260352583![]()

You can vote if you were a

stockholder of record as of the

close of business on April 8, 2021 2018.2021. You will receive a confirmation of your registration, with a control number, by email from Computershare. At the time of the meeting, go to www.meetingcenter.io/260352583 and enter your control number and the meeting password, XPO2021.Voting Matters and Board Recommendations2018 annual meeting2021 Annual Meeting of stockholdersStockholders other than those shown below.Board Vote

RecommendationPage Reference (for(for more detail)

PROPOSAL 1: Election of Directors

To elect seven (7)eight (8) members of our Board of Directors for a term to expire at the 2019 annual meeting2022 Annual Meeting of stockholdersStockholders or until their successors are duly elected and qualified

![]() FOR

FOR

each Director

Nominee

9-19, 50

13-27, 66

PROPOSAL 2:Ratification of the Appointment of our Independent Public Accounting Firm

To ratify the appointment of KPMG LLP as ourthe company's independent registered public accounting firm for fiscal year 20182021.![]() FOR

FOR

64-65, 67 FOR 48-49, 51

PROPOSAL 3:Advisory Vote to Approve Executive Compensation

To conduct an advisory vote to approve the executive compensation of ourthe company's named executive officers (“NEOs”("NEOs") as disclosed in this proxy statementProxy Statement.

![]() FOR

FOR

68 FOR 23-45, 52PROPOSAL 4:Advisory Vote on Frequency of Future Advisory Votes to Approve Executive CompensationTo consider an advisory vote on the frequency of future advisory votes to approve executive compensation ONE YEAR53

PROPOSAL 5:4: Stockholder Proposal Regarding an Annual Sustainability Report

To issueadopt a requirement that the company provide an annual sustainability report regarding environmental, socialdisclosure of its political activities and governance-related issues affecting the companyrelated expenditures.

![]() AGAINST

AGAINST

54-55PROPOSAL 6:Stockholder Proposal Regarding the Company’s Executive Compensation Clawback PolicyTo adopt an amendment to the clawback policy to allow the company to recoup compensation under certain conditions

AGAINST69-7056-57 1 ©2018 XPO Logistics, Inc.

PROPOSAL 5: Stockholder Proposal Regarding the Requirement that the Chairman of the Board be an Independent Director

To adopt a requirement that the chairman of the Board be an independent director.

![]() AGAINST

AGAINST

71-73

| | ||||||||

| | | | | | | | |

How to Cast Your Vote

If you are a registered stockholder (i.e., you hold your shares in your own name), you can vote by proxy in three convenient ways:

Telephone and internet voting facilities for stockholders of record will be available 24 hours a day and will close at 1:00 a.m. Eastern Daylight Time on May 17, 2018.

If you are the beneficial owner of shares, please follow the voting instructions provided by your broker, trustee or other nominee.

Board of Directors NomineesCase of a Change in Control

The following table provides summary information about each director nominee. Each director is elected annually by a majority of the votes cast. The average age of our director nominees is 60 years and the average tenure is 5.1 years.

Committee Memberships

| ||||||||||||||||

Name

|

Age

|

Director

|

Occupation

|

Independent

|

AC

|

CC

|

NCGC

|

AcqC

| ||||||||

Bradley S. Jacobs

| 61

| 2011

| Chairman and Chief Executive Officer, XPO Logistics, Inc.

| |||||||||||||

Gena L. Ashe

| 56

| 2016

| Former Senior Vice President, Chief Legal Officer and Corporate Secretary, Adtalem Global Education Inc.

| Y

| C

| |||||||||||

AnnaMaria DeSalva

| 49

| 2017

| Former Global Chief Communications Officer, E.I. du Pont de Nemours & Co. (DuPont)

| Y

| ||||||||||||

Michael G. Jesselson

| 66

| 2011

| Lead Independent Director, XPO Logistics, Inc. President and Chief Executive Officer, Jesselson Capital Corporation

| Y

| ✓

| ✓

| ||||||||||

Adrian P. Kingshott

| 58

| 2011

| Chief Executive Officer, AdSon LLC

| Y

| ✓

| C

| ✓

| |||||||||

Jason D. Papastavrou*

| 55

| 2011

| Founder and Chief Investment Officer, ARIS Capital Management, LLC

| Y

| ✓

| ✓

| ✓

| C

| ||||||||

Oren G. Shaffer*

| 75

| 2011

| Former Vice Chairman and Chief Financial Officer, Qwest Communications International, Inc.

| Y

| C

| |||||||||||

| ||

To adopt a policy that, in the event of a change in control of the company, there shall be no acceleration of vesting of any equity award granted to any senior executive officer. | ||

|

|

|

|

74-75 | ||||||||||||

| | | | | | | | | |

| | | | | | | | |

| | | | 1 | | | | ©2021 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

Governance and Compensation HighlightsTable of Contents

GOVERNANCE HIGHLIGHTS |

| | | |

| Board and Committee Independence |

| |

| | | |

| Independent Board Oversight and Leadership Roles | In 2016, our Board added a robust lead independent director position to its leadership structure to complement the roles of our independent committees and independent committee | |

| | ||

| | | |

| Board Refreshment | Our Board is committed to | |

| | | |

| Committee | As part of its annual review of | |

| new perspectives. | ||

| | ||

| | | |

| Director Elections | All directors are elected annually forone-year terms or until their successors are elected and qualified. | |

| | | |

| Majority Voting for Director Elections | Our bylaws provide for a majority voting standard in uncontested elections, and further require that a director who fails to receive a majority vote must tender his or her resignation to the Board. | |

| | ||

| | | |

| Board Evaluations | Our Board | |

| | | |

| Risk Oversight and Financial Reporting | Our Board seeks to provide robust oversight of current and potential risks facing our company by engaging in regular deliberations and | |

| oversight through regular meetings with management and dialogue with our auditors. | ||

| |

| |

| | | |

Our | ||

| | | |

In | ||

| | | |

| | | | | | | | | |

|

| | | 2 | | | | ©2021 XPO Logistics, Inc. | |

| | | | | | | | | |

| | | | | | | | |

2021 BOARD OF DIRECTORS NOMINEES |

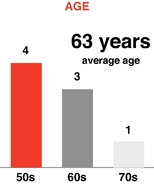

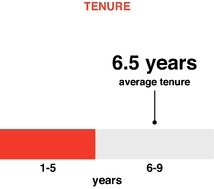

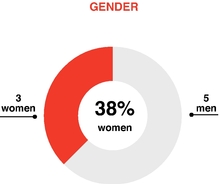

Our Board aims to create a diverse and highly skilled team of directors who provide our global company with thoughtful board oversight. When selecting new directors, our Board considers, among other things, the nominee's breadth of experience, financial expertise, integrity, ability to make independent analytical inquiries, understanding of our business environment, skills in areas relevant to our growth drivers and willingness to devote adequate time to Board duties—all in the context of the needs of the Board at that point in time, and with the objective of ensuring a diversity of backgrounds, expertise and viewpoints. Our Board also endeavors to include highly qualified women and individuals from underrepresented minority groups in the candidate pool, and has engaged in a purposeful process of regular refreshment. This has resulted in the addition of three new directors to the Board, one in 2016, one in 2017 and one in 2019. All three of these directors are female, adding diversity to our Board. The composition of our Board at year-end 2020 was:

|  |  |

The following table provides summary information about each director nominee. Each director is elected annually by a majority of the votes cast.

| Committee Memberships | ||||||||||||||||

| | | | | | | | | | | | | | | | | |

| Name | Director Since | Age | Occupation | Independent | AC | CC | NCGSC | AcqC | ||||||||

| | | | | | | | | | | | | | | | | |

Brad Jacobs | 2011 | 64 | Chairman and Chief Executive Officer, XPO Logistics, Inc. | | | | | | ||||||||

Gena Ashe | 2016 | 59 | General Counsel and Corporate Secretary, Anterix Inc. | Y | ✓ | ✓ | ||||||||||

Marlene Colucci | 2019 | 58 | Executive Director of The Business Council | Y | | ✓ | | ✓ | ||||||||

AnnaMaria DeSalva | 2017 | 52 | Vice Chairman, XPO Logistics, Inc.; | Y | C | |||||||||||

Michael Jesselson | 2011 | 69 | Lead Independent Director, XPO Logistics, Inc.; President and Chief Executive Officer, Jesselson Capital Corporation | Y | ✓ | ✓ | ✓ | | ||||||||

Adrian Kingshott | 2011 | 61 | Chief Executive Officer, AdSon, LLC; | Y | C | |||||||||||

Jason Papastavrou* | 2011 | 58 | Founder and Chief Investment Officer, ARIS Capital Management, LLC | Y | ✓ | C | ✓ | | ||||||||

Oren Shaffer* | 2011 | 78 | Former Vice Chairman and Chief Financial Officer, Qwest Communications International, Inc. | Y | C | |||||||||||

| | | | | | | | | | | | | | | | | |

AC = Audit Committee CC = Compensation Committee | NCGSC = Nominating, Corporate Governance and Sustainability Committee AcqC = Acquisition Committee | C = Committee Chairman ✓= Committee Member * = Audit Committee Financial Expert |

| | | | | | | | |

| | | | 3 | | | | ©2021 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

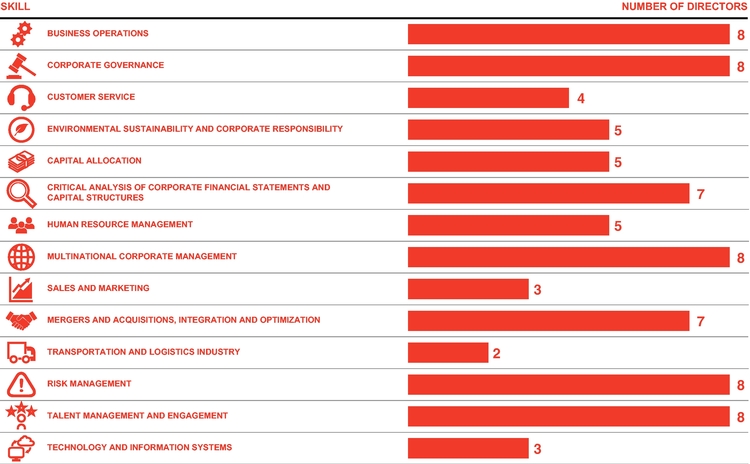

The following table provides a summary of the qualifications and experience of our director nominees.

| | | | | | | | |

| | | | 4 | | | | ©2021 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

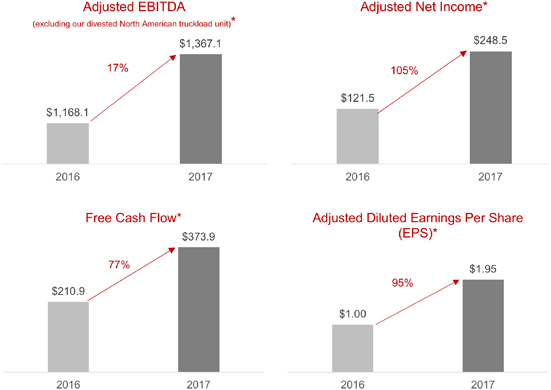

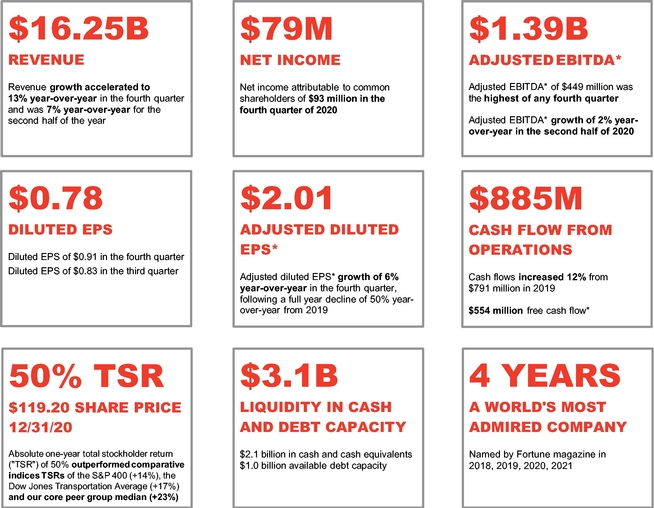

2020 PERFORMANCE HIGHLIGHTS |

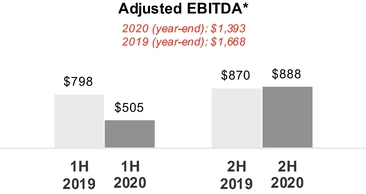

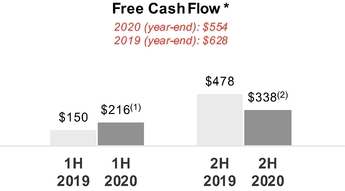

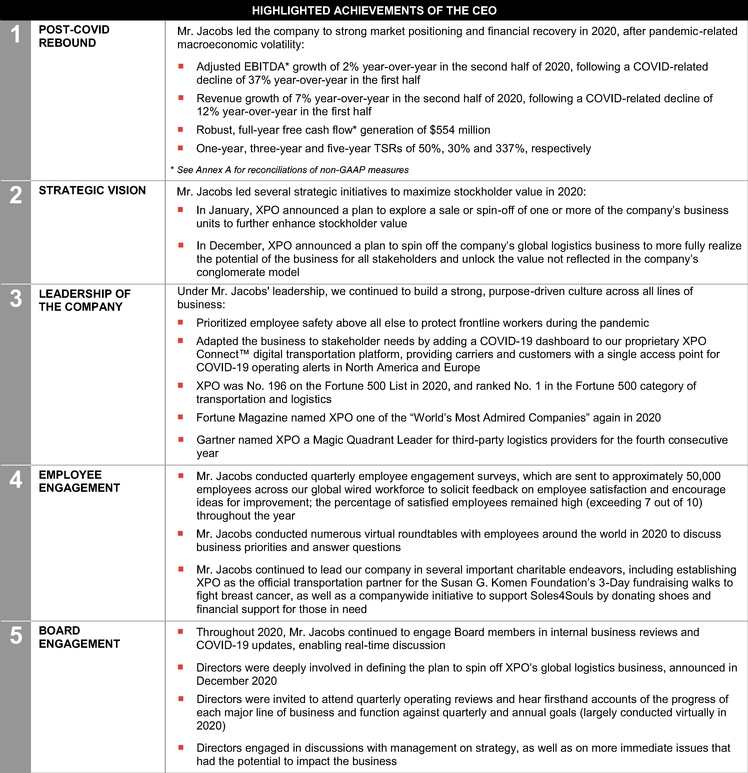

XPO generated positive financial achievements in 2020, arising from a financial rebound and upward momentum in the second half of the year. Under the skilled leadership of our NEOs, in 2020 we reported:

* See Annex A for reconciliations of non-GAAP measures

RESPONSE TO COVID-19 |

Throughout the COVID-19 pandemic, we have prioritized the health, safety and well-being of our employees and the communities in which we operate, taking these and other measures in 2020:

- ■

- Created a cross-disciplinary crisis management team, inclusive of all of our executive officers, to oversee all aspects of our response to COVID-19, including health and safety, operating plan and financial strategy. The Board received frequent updates from this team at formal meetings and through informal participation with this group.

- ■

- Implemented Paid Pandemic Sick Leave, which allowed full-time and part-time employees to receive up to 80 and 48 hours of additional paid sick leave, respectively.

- ■

- Paid out $57 million in COVID-related costs in the second and third quarters, including Frontline Appreciation Pay, which resulted in warehouse workers earning an additional $2 per hour and salaried employees earning additional weekly sums of $100 to $250.

- ■

- Fully covered the cost of COVID-19 testing and made additional resources available to employees and families, including mental health counseling.

- ■

- Donated and distributed PPE and other essential supplies in the communities where we operate.

The COVID-19 pandemic also highlighted the benefits of our long-standing investment in technology, which positioned XPO to participate in Operation Warp Speed, the U.S. public-private partnership to distribute vaccine supplies. We leveraged our cold-chain logistics expertise and expedited transportation fleet to help combat the pandemic.

Additional details about XPO's commitment to safety and our strategy for COVID-related risk management can be found on our website at xpo.com/covid19.

| | | | | | | | |

| | | | 5 | | | | ©2021 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

SUSTAINABILITY EFFORTS |

We are pleased to have published our 2020 Sustainability Report highlighting our initiatives in the following areas:

2020 STOCKHOLDER ENGAGEMENT AND RESPONSIVENESS |

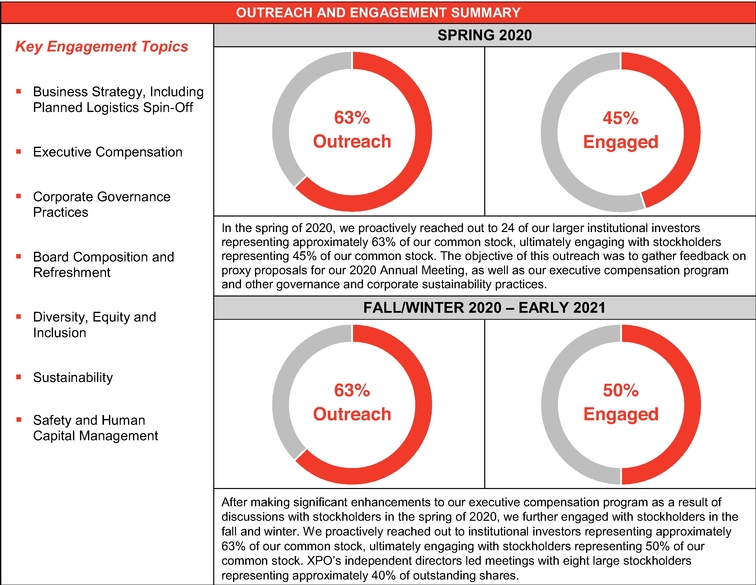

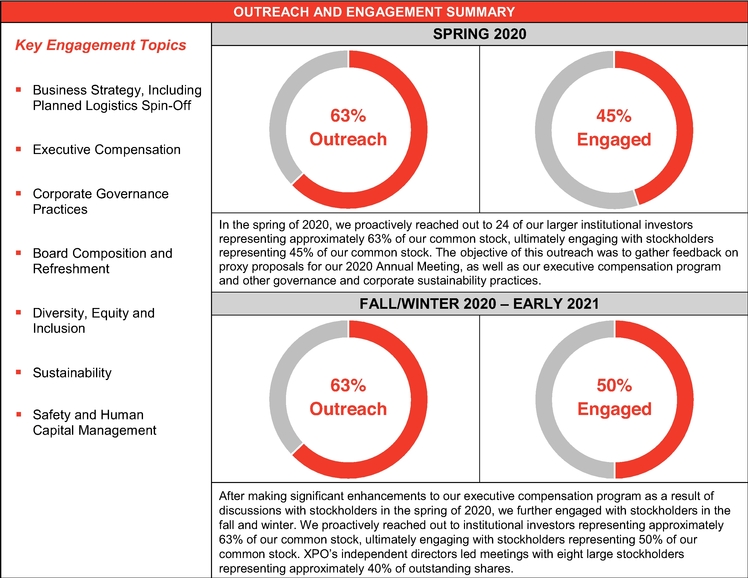

XPO's Board and management team are committed to engaging with stockholders to ensure our practices continue to align with the long-term interests of our stockholders. The feedback received during these conversations helped inform the company's compensation, sustainability and human capital management.

In 2020, XPO engaged with stockholders to discuss our governance, compensation, sustainability and business practices in two separate periods—in the weeks leading up to our 2020 Annual Meeting as well as in the latter months of the year, continuing through early 2021.

| | | | | | | | |

| | | | 6 | | | | ©2021 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

Further details about Compensation Committee decisions resulting from stockholder engagement are described in the "Stockholder Outreach and Engagement" section of the Compensation Discussion and Analysis.

2020 COMPENSATION HIGHLIGHTS |

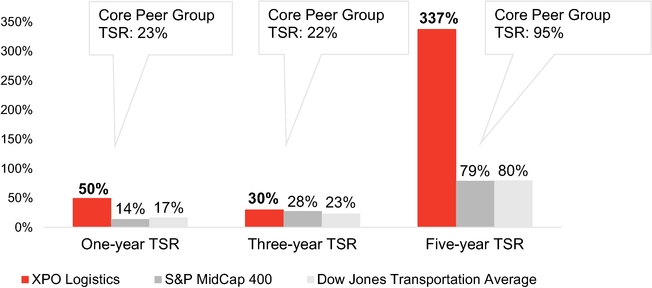

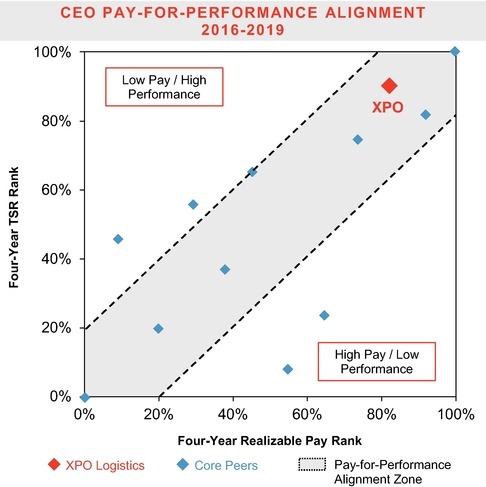

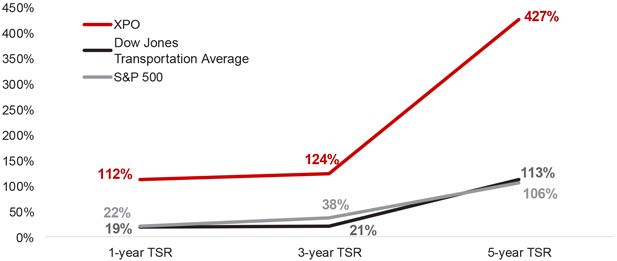

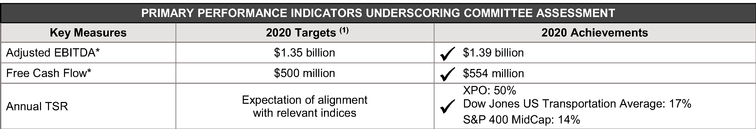

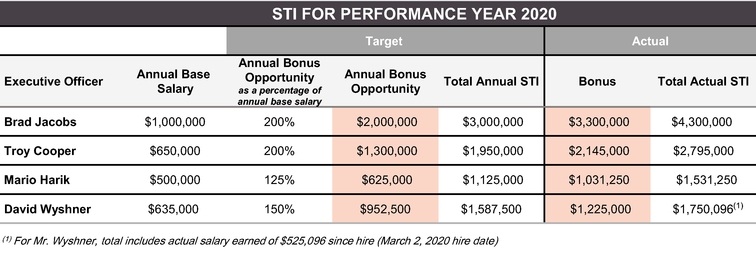

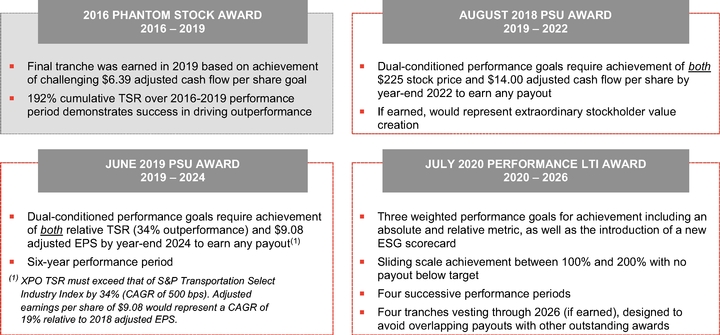

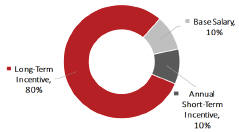

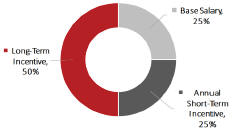

The Compensation Committee's pay-for-performance philosophy is focused on rewarding our executives for performance that creates substantial, long-term value for our stockholders. As a result, long-term incentive compensation is tied to ambitious goals for key operational indicators which incentivize our executives to drive long-term stockholder value creation. Over time, our financial and operational results have demonstrated the merits of this philosophy for our stockholders and our granting practices have proven successful in aligning pay outcomes with performance.

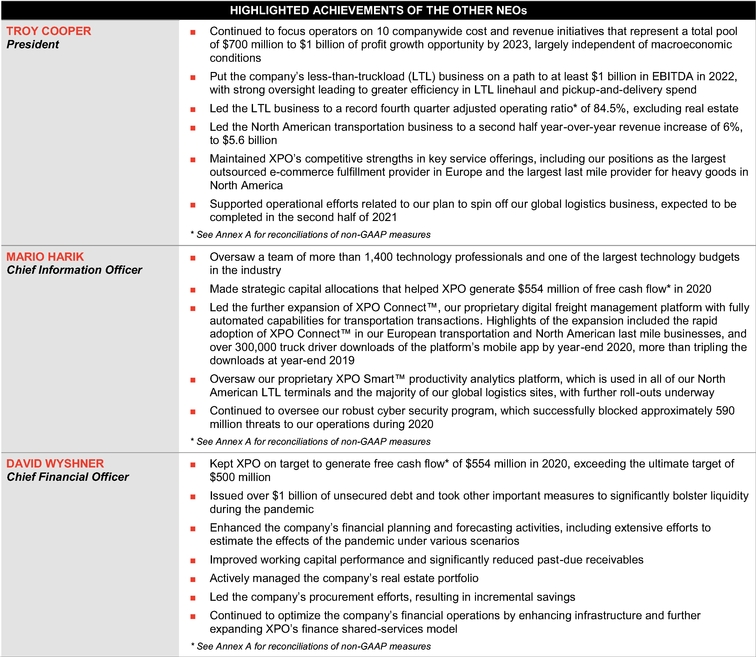

During 2020, NEOs acted decisively to navigate through the pandemic by prioritizing the safety of our employees, while ensuring continuity of service for our customers. The leadership of our NEOs and the resilience of our business model preserved value for our stockholders and positioned the company for a dramatic rebound in the second half of the year. As the economy continues to recover, our strengths are aligned with major industry tailwinds that emerged in 2020: logistics automation, the ongoing growth in e-commerce and supply chain outsourcing. Due in large part to the exemplary leadership of our NEOs in 2020, XPO is well-positioned to capitalize on these strategic opportunities. Accordingly, the Compensation Committee took into account the company's strong financial positioning and recovery at 2020 year-end when determining annual short-term incentive compensation.

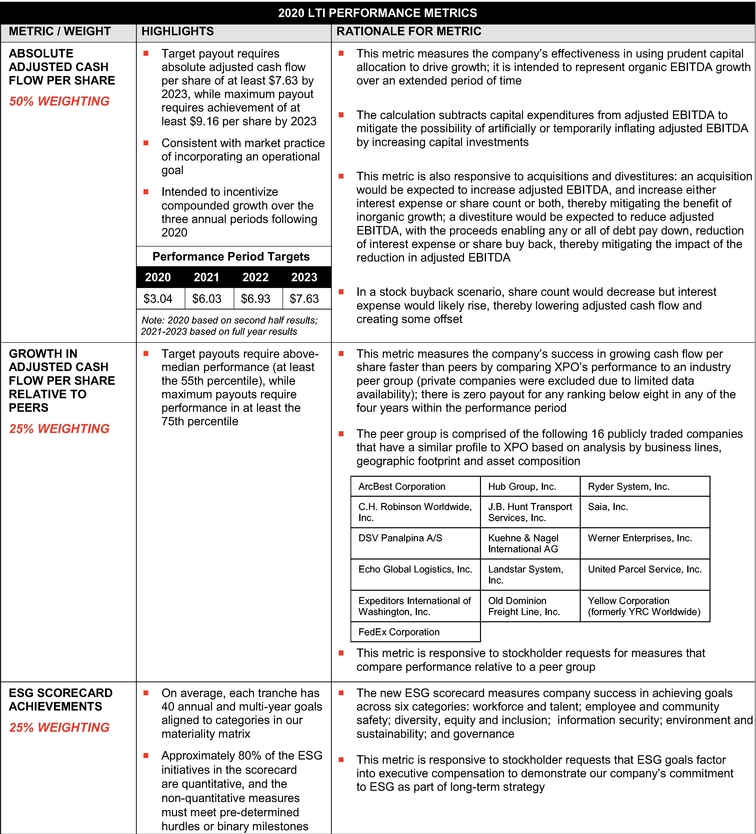

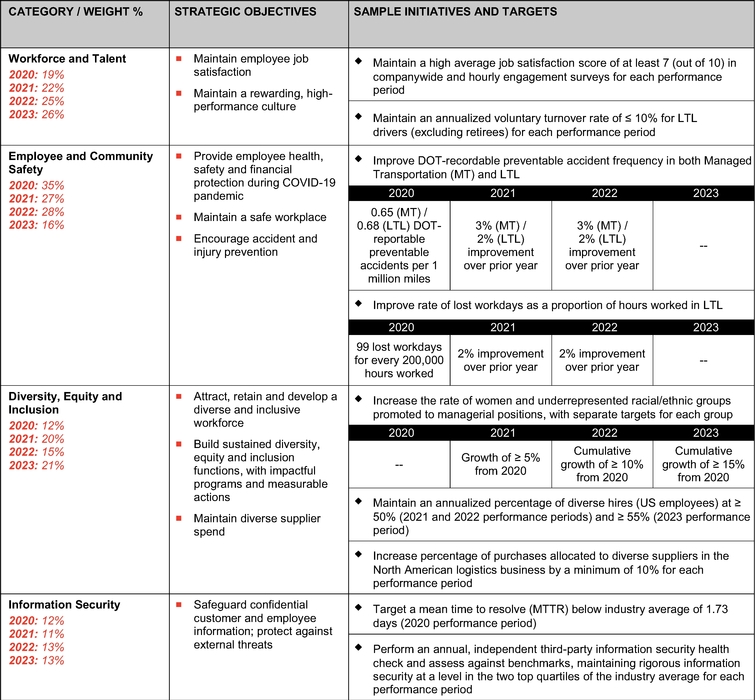

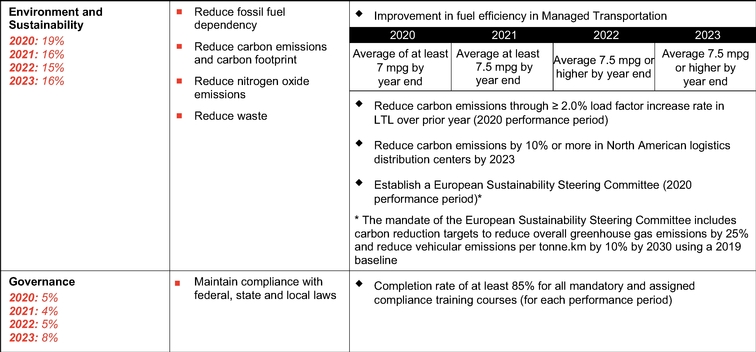

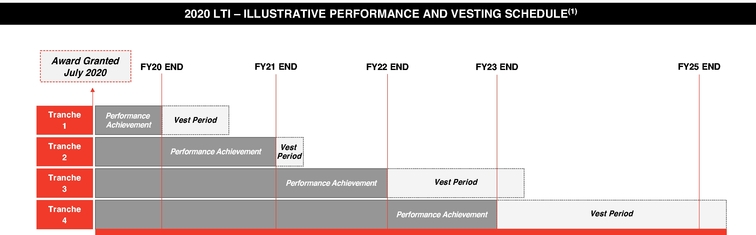

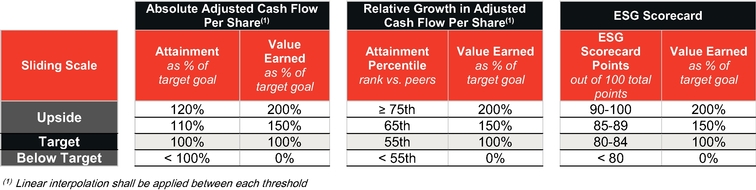

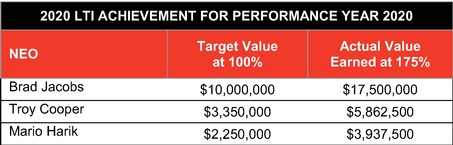

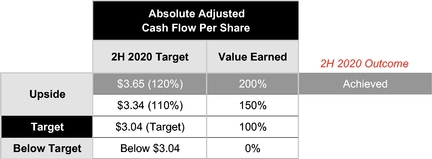

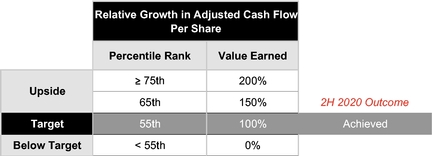

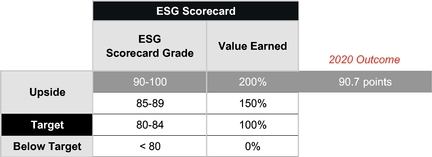

In connection with the execution of new, four-year employment agreements, in July 2020, long-term incentive awards were granted to Mr. Jacobs, Mr. Cooper and Mr. Harik. The structure of the award incorporates stockholder feedback received prior to our 2020 Annual Meeting. The awards are fully performance-based and include four tranches vesting through January 2026. Each tranche may be earned at a level ranging from zero to 200% of target value, depending on the degree of achievement of goals tied to both absolute and relative adjusted cash flow per share and ESG performance. If a goal for a given tranche is not achieved, the portion of the award associated with that goal will be forfeited. Awards are based on rigorous performance targets, with no payouts for below-target performance.

Further details about executive compensation decisions are described in the "Executive Compensation Elements and Outcomes for 2020" section of the Compensation Discussion and Analysis.

| | | | | | | | |

| | | | 7 | | | | ©2021 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

This proxy statementProxy Statement sets forth information relating to the solicitation of proxies by the Board of Directors (our “Board"Board of Directors”Directors" or our “Board”"Board") of XPO Logistics, Inc. (“XPO”("XPO" or our “company”"company") in connection with our company’s 2018 annual meeting2021 Annual Meeting of stockholdersStockholders (the "Annual Meeting") or any adjournment or postponement of the annual meeting.thereof. This proxy statementProxy Statement is being furnished by our Board of Directors for use at the annual meeting of stockholdersAnnual Meeting to be held on May 17, 201811, 2021 at 10:00 a.m. Eastern Daylight Time as a webcast due to the public health concerns related to COVID-19. You can access the meeting at Doral Arrowwood, 975 Anderson Hill Road, Rye Brook, NY 10573.www.meetingcenter.io/260352583 with password XPO2021. You will also be required to have a control number to access the Annual Meeting. Please follow the instructions below to receive your control number.

This proxy statementProxy Statement and form of proxy are first being mailed on or about April 18, 2018,13, 2021, to our stockholders of record as of the close of business on April 6, 20188, 2021 (the “Record Date”"Record Date").

Questions And Answers About Our Annual Meeting

The following questions and answers address some questions you may have regarding the annual meeting.our Annual Meeting. These questions and answers may not include all of the information that may be important to you as a stockholder of our company. Please refer to the more detailed information contained elsewhere in this proxy statement.Proxy Statement.

What items of business will be voted on at the annual meeting?

What items of business will be voted on at the Annual Meeting? |

We expect that the business put forth for a vote at the annual meetingAnnual Meeting will be as follows:

- ■

- To elect eight (8) members of our Board of Directors for a term to expire at the 2022 Annual Meeting of Stockholders or until their successors are duly elected and qualified (Proposal 1);

- ■

- To ratify the appointment of KPMG LLP ("KPMG") as our independent registered public accounting firm for fiscal year 2021 (Proposal 2);

- ■

- To conduct an advisory vote to approve the executive compensation of our named executive officers ("NEOs") as disclosed in this Proxy Statement (Proposal 3);

- ■

- To consider and act upon a stockholder proposal regarding additional disclosure of the company's political activities, if properly presented at the Annual Meeting (Proposal 4);

- ■

- To consider and act upon a stockholder proposal regarding the appointment of an independent chairman of the board, if properly presented at the Annual Meeting (Proposal 5);

- ■

- To consider and act upon a stockholder proposal regarding the acceleration of executive equity awards in the case of a change in control of the company, if properly presented at the Annual Meeting (Proposal 6); and

- ■

- To consider and transact other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

In addition, seniorSenior management of XPO and representatives of our outside auditor, KPMG, will be available to respond to appropriate questions.

Who can attend and vote at the annual meeting?

Who can attend and vote at the Annual Meeting? |

You are entitled to receive notice of, and to attend and vote at the annual meeting,Annual Meeting, or any adjournment or postponement thereof, if, as of the close of business on April 6, 2018,8, 2021, the Record Date, you were a holder of record of our common stock or Series A Convertible Perpetual Preferred Stock (the “Series"Series A Preferred Stock”Stock").

You will not be able to attend the Annual Meeting in person this year due to COVID-19 safety precautions. You can access the Annual Meeting at www.meetingcenter.io/260352583 with password XPO2021. You will be required to provide the control number on your proxy card to access the Annual Meeting. If the shares of common stock you hold are in an account at a broker, dealer, commercial bank, trust company or other nominee (i.e., in "street name"), you must register in advance to participate in the Annual Meeting, vote electronically and submit questions during the live webcast of the meeting. To register, you must obtain a legal proxy from the bank, broker or other nominee that holds your shares giving you the right to vote the shares. Requests for registration should be directed to Computershare by email at legalproxy@computershare.com no later than 5:00 p.m. Eastern Time, on Thursday, May 6, 2021. You will receive a confirmation of your registration, with a control number, by email from Computershare. At the time of the meeting, go to www.meetingcenter.io/260352583 and enter your control number and the meeting password, XPO2021.

| | | | | | | | |

| | | | 8 | | | | ©2021 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

Can I ask questions during the Annual Meeting? |

Stockholders (or their proxy holders) may submit questions for the Annual Meeting's question and answer session in advance by logging on to the meeting site at www.meetingcenter.io/260352583 with password XPO2021. You will need the control number on your proxy card or confirmation email from Computershare in order to submit a question. Click on the "message" icon at the top of the screen and submit your question. Please provide your name, address (city and state) and organization, and, if applicable, the specific proposal to which your question relates. Questions can be submitted in advance of the Annual Meeting beginning at 9:00 a.m., Eastern Time, on May 10, 2021. Questions may also be submitted during the Annual Meeting through the meeting website. We will answer as many questions during the meeting as time will allow and will group questions together where appropriate.

How many shares of XPO common stock or Series A Preferred Stock must be present to conduct business at the Annual Meeting? |

As of the Record Date, there were 120,597,574111,676,088 shares of common stock issued and outstanding, with each of which isshare entitled to one vote on each matter to come before the annual meeting.Annual Meeting. In addition, as of the Record Date, there were 71,510 shares of Series A Preferred Stock issued and outstanding. Eacheach share of Series A Preferred Stock is entitled to vote together with our common stock on each matter to come before the annual meetingAnnual Meeting as if the shares of Series A Preferred Stock were converted into shares of common stock as of the Record Date, meaning that each share of Series A Preferred Stock is entitled to approximately 143 votes on each matter to come before the annual meeting.Annual Meeting. As a result, aof the Record Date, there were 40 shares of Series A Preferred Stock issued and outstanding, representing 5,714 votes. In total, of 130,813,288111,681,802 votes are eligible to be cast at the annual meetingAnnual Meeting based on the number of outstanding shares of our common stock and Series A Preferred Stock, voting together as a single class.

If you wish to attend the annual meeting and your shares are held in an account at a broker, dealer, commercial bank, trust company or other nominee (i.e., in “street name”), you will need to bring a copy of your voting instruction card or statement reflecting your share ownership as of the Record Date, as well as an admission ticket as outlined below. Street name stockholders who wish to vote at the annual meeting will need to obtain a proxy from the broker, dealer, commercial bank, trust company or other nominee that holds their shares.

Do I need a ticket to attend the annual meeting?

Yes, you will need an admission ticket to enter the annual meeting. You may request tickets by providing the name under which you hold shares of record or, if your shares are held in the name of a bank, broker or other holder of record, the evidence of your beneficial ownership of the shares as of the Record Date, the number of tickets you are requesting and your contact information. You can submit your request in the following ways:

Stockholders also must present a form of personal photo identification in order to be admitted to the annual meeting. No cameras, mobile phones or other electronic or recording devices will be allowed to be used in the meeting room.

How many shares must be present to conduct business at the annual meeting?

A quorum is necessary to hold a valid meeting of stockholders. ForPursuant to the company's bylaws, the presence, in person or by proxy, of the holders of a majority of the shares issued and outstanding is necessary for each of the proposals to be presented at the annual meeting, theAnnual Meeting. Accordingly, holders of shares of our common stock or Series A Preferred Stock outstanding on the Record Date representing 65,406,64555,840,902 votes must be present at the annual meeting, in person or by proxy.Annual Meeting. If you vote—includingvote by internet, telephone or proxy card—yourcard, the shares votedyou vote will be counted towardstoward the quorum for the annual meeting.Annual Meeting. Abstentions and brokernon-votes are counted as present for the purpose of determining a quorum.

What are my voting choices? |

What are my voting choices?

With respect to the election of directors, you may vote “FOR”"FOR" or“AGAINST”"AGAINST" each of the director nominees, or you may“ABSTAIN”"ABSTAIN" from voting for one or more of such nominees. With respect to the other proposals to be considered at the annual meeting, except the frequency vote on executive compensation,Annual Meeting, you may vote“FOR”"FOR" or“AGAINST”"AGAINST" or you may“ABSTAIN”"ABSTAIN" from voting on any proposal. With respect to the advisory vote on the frequency of future advisory votes to approve executive compensation, you may vote for one of four choices for the proposal on the proxy card or voting instruction:“ONE YEAR,”“TWO YEARS,”“THREE YEARS” or“ABSTAIN.”If you sign your proxy or voting instruction card without giving specific instructions, your shares will be voted in accordance with the recommendations of our Board of Directors with respect to the specific proposals described in this Proxy Statement and at the discretion of the proxy holders on any other matters that properly come before the annual meeting.Annual Meeting.

What vote is required to approve the proposals being considered at the Annual Meeting? |

- ■

- Proposal 1: Election of eight (8) directors. The election of each of the eight (8) director nominees named in this Proxy Statement requires the affirmative vote of a majority of the votes cast (meaning the number of shares voted "for" a nominee must exceed the number of shares voted "against" such nominee) by holders of shares of our common stock (including those shares that would be issued if all of our outstanding Series A Preferred Stock had converted into shares of our common stock as of the Record Date) at the

annual meeting?Annual Meeting at which a quorum is present. If any incumbent director standing for re-election receives a greater number of votes "against" his or her election than votes "for" such election, our bylaws require that such person must promptly tender his or her resignation to our Board of Directors. You may not accumulate your votes for the election of directors.∎Proposal 1: Election of seven (7)directors.The election of each of the seven (7) director nominees named in this proxy statement requires the affirmative vote of a majority of the votes cast (meaning the number of shares voted “for” a nominee must exceed the number of shares voted “against” such nominee) by holders of shares of our common stock (including those that would be issued if all of our outstanding Series A Preferred Stock had converted into shares of our common stock as of the Record Date) at the annual meeting at which a quorum is present. If any incumbent director standing forre-electionreceives a greater number of votes “against” his or her election than votes “for” such election, our bylaws require that such person must promptly tender his or her resignation to our Board of Directors. You may not accumulate your votes for the election of directors.Brokers may not use discretionary authority to vote shares of our common stock on the election of directors if they have not received specific instructions from their clients. If you are a beneficial owner of shares of our common stock, in order for your vote to be counted in the election of directors, you will need to communicate your voting decisions to your bank, broker or other nominee before the date of the

annual meetingAnnual Meeting in accordance with their specific instructions. Abstentions and brokernon-votes are not considered votes cast for purposes of tabulationof such vote,and will have no effect on the election of director nominees. - ■

- Proposal 2: Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2021. Ratification of the appointment of KPMG as our independent registered public accounting firm for the year ending December 31, 2021 requires the affirmative vote of a majority of the votes cast (meaning the number of shares voted "for" such proposal must exceed the number of shares voted "against" such proposal) by holders of shares of our common stock (including those shares that would be issued if all our outstanding Series A Preferred Stock had converted into shares of our common stock as of the Record Date) at the Annual Meeting at which a quorum is present. Abstentions are not considered votes cast for purposes of tabulation and will have no effect on the proposed ratification of KPMG. We do not expect any broker non-votes, as brokers have discretionary authority to vote on this proposal.

| |

| | | | | | |||||||

| | | | 9 | | | | ©2021 | ||||

| | | | | | | | | ||||

| | | | | | | | |

Brokers may not use discretionary authority to vote shares of our common stock on the advisory vote to approve executive compensation if they have not received specific instructions from their clients. If you are a beneficial owner of shares of our common stock, in order for your vote to be counted in the advisory vote to approve executive compensation, you will need to communicate your voting decisions to your bank, broker or other nominee before the date of the annual meetingAnnual Meeting in accordance with their specific instructions. Abstentions and brokernon-votes are not considered votes cast for purposes of tabulation of such vote, and will have no effect on the advisory vote to approve executive compensation.

Brokers may not use discretionary authority to vote shares on the advisory vote on frequency of future advisory votes to approve executive compensation if they have not received specific instructions from their clients. If you are a beneficial owner of shares, for your vote to be counted in the advisory vote on frequency of future advisory votes to approve executive compensation, you will need to communicate your voting decisions to your bank, broker or other nominee before the date

Brokers may not use discretionary authority to vote shares on this stockholder proposal if they have not received specific instructions from their clients. If you are a beneficial owner of shares, for your vote to be counted for or against the stockholder proposal regarding annual sustainability reporting, you will need to communicate your voting decision to your bank, broker or other nominee before the date of the annual meeting in accordance with their specific instructions. Abstentions and brokernon-votes are not considered votes cast for purposes of tabulation of such vote, and will have no effect on the vote on this stockholder proposal.

Brokers may not use discretionary authority to vote shares on this stockholder proposal if they have not received specific instructions from their clients. If you are a beneficial owner of shares, for your vote to be counted for or against the stockholder proposal regarding an amendment to the clawback policy, you will need to communicate your voting decision to your bank, broker or other nominee before the date of the annual meeting in accordance with their specific instructions. Abstentions and brokernon-votes are not considered votes cast for purposes of tabulation of such vote, and will have no effect on the vote on this stockholder proposal.

In general, other business properly brought before the annual meetingrelated expenditures requires the affirmative vote of a majority of the votes cast (meaning the number of shares voted “for”"for" such proposal must exceed the number of shares voted “against”"against" such proposal) by holders of shares of our common stock (including those shares that would be issued if all our outstanding Series A Preferred Stock had converted into shares of our common stock as of the Record Date) at the annual meetingAnnual Meeting at which a quorum is present.

In general, other business properly brought before the Annual Meeting at which a quorum is present requires the affirmative vote of a majority of the votes cast (meaning the number of shares voted "for" such proposal must exceed the number of shares voted "against" such proposal) by holders of shares of our common stock (including those shares that would be issued if all our outstanding Series A Preferred Stock had converted into shares of our common stock as of the Record Date).

| | | | | | | | |

| | | | 10 | | | | ©2021 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

How does the BoardTable of Directors recommend that I vote?Contents

How does the Board of Directors recommend that I vote? |

Our Board of Directors, after careful consideration, recommends that our stockholders vote“FOR”"FOR" the election of each director nominee named in this proxy statement,“FOR”Proxy Statement, "FOR" ratification of KPMG as our independent registered public accounting firm for fiscal year 2018,“FOR”2021, "FOR" the advisory approval of the resolution to approve executive compensation, for the option of every“ONE YEAR” as the preferred frequency for future advisory votes to approve executive compensation,“AGAINST”"AGAINST" the approval of the stockholder proposal regarding annual sustainability reporting,additional disclosure of the company's political activities, if such proposal is properly presented at the meeting, and“AGAINST”meeting; "AGAINST" the approval of the stockholder proposal regarding the company’s executive compensation clawback policy,requirement that the chairman of the board be an independent director, if such proposal is properly presented at the meeting; and "AGAINST" the approval of the stockholder proposal regarding acceleration of executive equity awards in the case of a change in control, if such proposal is properly presented at the meeting.

What do I need to do now? |

We urge you to read this proxy statementProxy Statement carefully, then vote via internet or by telephone by following the instructions on the proxy card, or mail your completed, dated and signed proxy card in the enclosed return envelope as soon as possible, so that your shares of our common stock can be voted at the annual meeting of stockholders. Holders of record may also vote by telephone or the internet by following the instructions on the proxy card.Annual Meeting.

How do I cast my vote? |

How do I cast my vote?

Registered Stockholders. If you are a registered stockholder (i.e., you hold your shares in your own name through our transfer agent, Computershare Trust Company, N.A., and not through a broker, bank or other nominee that holds shares for your account in “street name”"street name"), you may vote by proxy via the internet or by telephone or by mail by following the instructions provided on the proxy card.card, or mail your completed, dated and signed proxy card in the enclosed return envelope. Proxies submitted via telephoneinternet or internetby telephone must be received by 1:00 a.m. Eastern Daylight Time on May 17, 2018.11, 2021. Please see the proxy card provided to you for instructions on how to submit your proxy via internet or by telephone or the internet.telephone. Stockholders of record who attend the annual meetingAnnual Meeting may vote in persondirectly at the Annual Meeting by obtaining a ballot fromfollowing the inspector of elections.instructions provided during the Annual Meeting.

Beneficial Owners. If you are a beneficial owner of shares (i.e., your shares are held in the name of a brokerage firm, bank or a trustee), you may vote by proxy by following the instructions provided in the voting instruction form or other materials provided to you by the brokerage firm, bank or other nominee that holds your shares. To vote in persondirectly at the annual meeting,Annual Meeting, you must obtain a legal proxy from the brokerage firm, bank or other nominee that holds your shares. Follow the instructions provided above to obtain a control number and the voting instructions provided during the Annual Meeting.

What is the deadline to vote? |

If you hold shares as the stockholder of record, your vote by proxy must be received before the polls close at the annual meeting.Annual Meeting. As indicated on the proxy card provided to you, proxies submitted via telephoneinternet or internetby telephone must be received by 1:00 a.m. Eastern Daylight Time on May 17, 2018.11, 2021.

If you are the beneficial owner of shares of our common stock, please follow the voting instructions provided by your broker, trustee or other nominee.

What happens if I do not respond, or if I respond and fail to indicate my voting preference, or if I abstain from voting? |

If you fail to sign, date and returnvote via internet or by telephone as indicated on your proxy card, or fail to vote by telephone or internet as provided onproperly sign, date and return your proxy card, your shares will not be counted towards establishing a quorum for the annual meeting,Annual Meeting, which requires holders representing a majority of the outstanding shares of our common stock (including those that would be issued if all of our outstanding Series A Preferred Stock had converted into shares of our common stock as of the Record Date) to be present in person or by proxy.

Failure to vote, assuming the presence of a quorum, will have no effect on the tabulation of the votevotes on the proposals.

If you are a stockholder of record and you properly sign, date and return your proxy card, but do not indicate your voting preference, we will count your proxy as a vote“FOR”"FOR" the election of the seveneight nominees for director named in “Proposal"Proposal 1—Election of Directors,”“FOR”" "FOR" ratification of KPMG as our independent registered public accounting firm for fiscal year 2018,“FOR”2021, "FOR" advisory approval of the resolution to approve executive compensation, for a frequency of every“ONE YEAR” as the preferred frequency for future advisory votes to approve executive compensation,“AGAINST”"AGAINST" the approval of the stockholder proposal regarding annual sustainability reporting,additional disclosure of the company's political activities, if such proposal is properly presented at the annual meeting, and“AGAINST”meeting; "AGAINST" the approval of the stockholder proposal regarding the company’s executive compensation clawback policy,requirement that the chairman of the board be an independent director, if such proposal is properly presented at the annualmeeting; and "AGAINST" the approval of the stockholder proposal regarding acceleration of executive equity awards in the case of a change in control, if such proposal is properly presented at the meeting.

| | | | | | | | | ||||

| | | | 11 | | | | ©2021 | ||||

| | | | | | | | | ||||

| | | | | | | | |

If my shares are held in "street name" by my broker, dealer, commercial bank, trust company or other nominee, will my |

You should instruct your broker or other nominee on how to vote your shares of our common stock using the instructions provided by such broker or other nominee. Absent specific voting instructions, brokersthey provide to you. Brokers or other nominees who hold shares of our common stock in “street name”"street name" for customers are prevented by the rules set forth in the Listed Company Manual (the “NYSE Rules”"NYSE Rules") of the New York Stock Exchange (the “NYSE”"NYSE") from exercising voting discretion inwith respect ofto non-routine or contested matters. matters (i.e., they must receive specific voting instructions from a stockholder in order to vote that stockholder's shares on non-routine or contested matters). Shares not voted by a broker or other nominee, because they did not receive specific voting instructions from the stockholder on one or more proposals, are referred to as "broker non-votes."

We expect that when the NYSE evaluatesdetermines whether each of the six proposals to be voted on at the annual meeting to determine whether each proposalour Annual Meeting is a routine ornon-routine matter, only “Proposal"Proposal 2—Ratification of the Appointment of KPMG LLP as Our Independent Registered Public Accounting Firm for fiscal year 2018”Fiscal Year 2021" will be determined to be routine. Shares not voted by a broker or other nominee because such broker or other nominee does not have instructions or cannot exercise discretionary voting power with respect to one or more proposals are referred to as “brokernon-votes.” It is important that you instruct your broker or other nominee on how to vote your shares of our common stock held in “street name” in accordance with"street name" by following the voting instructions provided to you by suchyour broker or other nominee.

Can I change my vote after I have mailed my proxy card?

What if I want to change my vote? |

Yes. Whether you attend the annual meetingAnnual Meeting or not, you may revoke a proxy at any time before your proxy is voted at the annual meeting.Annual Meeting. You may do so by properly delivering a later-dated proxy either via internet, by telephone, by mail, the internet or telephone or by attending the annual meeting in personAnnual Meeting virtually and voting. Please note, however, that your attendance at the annual meetingAnnual Meeting will not automatically revoke any prior proxy, unless you vote again at the annual meetingAnnual Meeting or specifically request in writing that your prior proxy be revoked. You also may revoke your proxy by delivering a notice of revocation to our company (Attention: Secretary, XPO Logistics, Inc., Five American Lane, Greenwich, Connecticut 06831) prior to the vote at the annual meeting.Annual Meeting. If you hold your shares through a broker, dealer, commercial bank, trust company or other nominee, you should follow the instructions of suchyour broker or other nominee regarding revocation of proxies.

How will the persons named as proxies vote? |

If you are a registered stockholder (i.e., you hold your shares of our common stock in your own name through our transfer agent, Computershare Trust Company, N.A., and not through a broker, bank or other nominee that holds shares for your account in "street name") and you complete and submit a proxy, the persons named as proxies will follow your instructions. If you submit a proxy but do not provide voting instructions, or if your instructions are unclear, the persons named as proxies will vote as recommended by our Board of Directors or, if no recommendation is given, by using their own discretion.

Where can I find the results of the voting? |

Where can I find the results of the voting?

We intend to announce preliminary voting results at the annual meetingAnnual Meeting and will publish final results throughon a Current Report on Form8-K to be filed with the U.S. Securities and Exchange Commission (“SEC”(the "SEC") within four (4) business days after the annual meeting.Annual Meeting. The Current Report on Form8-K will also be available on the internet at our website,www.xpo.com.

Who will pay for the cost of soliciting proxies?

Who will pay for the cost of soliciting proxies? |

WeThe company will pay for the cost of soliciting proxies. We have engaged Innisfree M&A Incorporated to assist us in soliciting proxies in connection with the annual meeting,Annual Meeting and have agreed to pay them approximately $12,500$15,000 plus their expenses for providing such services. Our directors, officers and other employees, without additional compensation, may solicit proxies personally, in writing, by telephone, bye-mail or otherwise. As is customary, we will reimburse brokerage firms, fiduciaries, voting trustees and other nominees for forwarding our proxy materials to each beneficial owner of shares of our common stock or Series A Preferred Stock held of record bythe Record Date through them.

What is “householding”

What is "householding" and how does it affect me? |

In cases where multiple company stockholders share the same address, and how does it affect me?

In accordance with notices to many stockholders who hold theirthe shares are held through a bank, broker or other holder of record (a “street-name stockholder”("street-name stockholders") and share a single address,, only one copy of our proxy statement and 2017 annual report to stockholders is beingmaterials will be delivered to that address unless contrary instructions from anya stockholder at that address are received.requests otherwise. This practice, known as “householding,”"householding," is intended to reduce our printing and postage costs. However, any such street-name stockholderstockholders residing at the same address who wisheswish to receive a separate copy of thisour proxy statement and annual reportmaterials may request a copy by contacting thetheir bank, broker or other holder of record, or by sending a written request to: Investor Relations, XPO Logistics, Inc., Five American Lane, Greenwich, Connecticut 06831, or by contacting Investor Relations by telephone at (855)976-6951.1-855-976-6951. The voting instruction form sent to a street-name stockholder should provide information on how to request: (1) householdingrequest a separate copy of future materials for each company materials, or (2) separate materialsstockholder at that address, if only one set of documentsthat is being sent to a household. A stockholder who would like to make one of these requests should contact us as indicated above.your preference.

Can I obtain an electronic copy of the company's proxy materials? |

Can I obtain an electronic copy of proxy materials?

Yes, this proxy statement, annual reportProxy Statement and proxy cardour 2020 Annual Report are available on the internet atwww.edocumentview.com/XPO.

| | | | | | | | | ||||

| | | | 12 | | | | ©2021 | ||||

| | | | | | | | | ||||

| | | | | | | | |

| CORPORATE GOVERNANCE | ||

| | | |

Introduction –An Overview of Our Mission and How Our Board Composition Is Aligned with Our Strategy

AN OVERVIEW OF OUR MISSION AND HOW OUR BOARD COMPOSITION IS ALIGNED WITH OUR STRATEGY |

Our mission is to be the leading provider of cutting-edge supply chain solutions to the most successful companies in the world by using our highly integrated network of people, technology and physical assets to help our customers manage their goods moremost efficiently throughout their supply chains. We run our business on a global basis, with more than 50,000 customers served by over 100,000 employees and employees in over 1,4551,629 locations in 3230 countries, including the United States, France, the United Kingdomprimarily in North America and Spain.Europe.

Our business has two segments, transportation and logistics—each has robust service offerings, leadership positions and growth prospects. Our transportation segment offers customers an unmatched networkprimarily provides less-than-truckload (LTL) and truck brokerage services in North America and Europe. We are a top three provider of multiple modes, flexible capacityLTL services in North America, and route density that transports freight quickly and cost effectively from origin to destination. Through ourwe have one of the largest LTL networks in Western Europe. In addition, we are the second largest truck brokerage provider globally. Our logistics segment we provide aprovides order fulfillment and other distribution services differentiated by our ability to deliver technology-enabled, customized solutions. We are the second largest logistics company in the world, with one of the largest outsourced e-commerce fulfilment platforms. Our logistics customers include many preeminent companies that benefit from our scale, automation and range of differentiated and data-intensive services, including highly engineered and customized solutions, value-added warehousing and distribution, cold chain distribution and other inventory management solutions.

vertical expertise. Our blueprint for transforming transportationsupply chain management is rooted in innovation and logistics revolves around innovationour people. We care deeply about keeping our employees and people. Ourcustomers happy, and we view safety, sustainability, strong governance and a purpose-driven culture as essential components of value creation. In addition, our company is a leading championproponent of supply chain technology, with a global team of technologists and data scientists who concentrate their efforts in four areas of innovation: automation and intelligent machines,machines; visibility and customer service, theservice; our proprietary digital freight marketplacetransportation platform; and dynamic data science. Our success depends on our people. We care deeply about keeping our employees and customers happy, and view giving back to communities, focusing on safety and sustainability and maintaining strong governance as essential components of value creation.

Our Board of Directors consists of a highly experiencedskilled group of business leaders who share our values and reflect our culture. Many of our directors have served as executive officers or on boards and board committeesmembers of major companies and have an extensive understanding of the principles of corporate governance. In addition, our directors have a strong owner orientation—as of the Record Date, approximately 15.4%17.5% of the voting power of our capital stock on a fully-diluted basis is held by our directors or by entities or persons related to our directors (as of the Record Date).directors. As described on page 13,19, our Board as a whole has broadextensive expertise within the following skill sets, thatall of which are relevant to our company, business, industry and strategies:strategy:

- ■

- Business operations;

- ■

- Corporate governance;

- ■

- Customer service;

- ■

- Environmental sustainability and corporate responsibility;

- ■

- Effective capital allocation;

- ■

- Critical analysis of corporate financial statements and capital structures;

- ■

- Human resource management;

- ■

- Multinational corporate management;

- ■

- Sales and marketing;

- ■

- Mergers and acquisitions, integration and optimization;

- ■

- The transportation and logistics industry;

- ■

- Risk management;

- ■

- Talent management and engagement; and

- ■

- Technology and information systems.

| | | | | | | | |

| | | | 13 | | | | ©2021 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

DIRECTORS |

Our Board of Directors currently consists of eight (8) members as set forth in the table below. The current term of each of our directors will expire at the 2018 annual meeting of stockholders.2021 Annual Meeting. Our Board of Directors has nominated seven (7)all of the current directors to stand forre-election election at the annual meeting,Annual Meeting, as set forth in Proposal 1 on page 5066 of this proxy statement.Proxy Statement.

| Name | Occupation | |

|---|---|---|

| | |

| Brad Jacobs |

| |

| Chairman and Chief Executive Officer, XPO Logistics, Inc. | |

Gena |

| |

|

| |

| AnnaMaria DeSalva | Vice Chairman, XPO Logistics, Inc.; Global Chairman and Chief Executive Officer, | |

|

| |

| Lead Independent Director, XPO Logistics, Inc.; President and Chief Executive Officer, Jesselson Capital Corporation | |

Adrian | Chief Executive Officer, AdSon, LLC; Managing Director, Spotlight Advisors, LLC | |

Jason | Founder and Chief Investment Officer, ARIS Capital Management, LLC | |

Oren | Former Vice Chairman and Chief Financial Officer, Qwest Communications International, Inc. | |

| | | |

While it does not currently exceed the required voting power thresholds, underUnder the terms of an Investment Agreement, dated June 13, 2011 (the “Investment Agreement”"Investment Agreement"), by and among Jacobs Private Equity, LLC (“JPE”("JPE"), the other investors party thereto (collectively with JPE, the “Investors”"Investors"), and our company, JPE has the right to designate certain percentages of the nominees for our Board of Directors so long as JPE owns securities (including preferred stock convertible into, or warrants exercisable for, securities) representing specified percentages of the total voting power of our capital stock on a fully-diluted basis. JPE does not currently own securities representing the required voting power to qualify for the right to designate nominees for our Board of Directors. The foregoing rights of JPE under the Investment Agreement are in addition to, and not in limitation of, JPE’sJPE's voting rights as a holder of capital stock of our company. JPE is controlled by Bradley S.Brad Jacobs, our Chairman of the Boardchairman and Chief Executive Officer.chief executive officer. The Investment Agreement and the terms contemplated therein were approved by our stockholders at a special meeting on September 1, 2011.

None of the foregoing will prevent our Board of Directors from acting in accordance with its fiduciary duties or applicable law or stock exchange requirements or from acting in good faith in accordance with our governing documents, while giving due consideration to the intent of the Investment Agreement.

Set forth below is information regarding each of our director nominees, including the experience, qualifications, attributes or skills that led our Board of Directors to conclude that each such personnominee should serve as a director.

| Brad Jacobs |

| Chairman and Director since 2011 | ||||||

Age: 64 | ||||||||

| ||||||||

| ||||||||

Other Public Company Boards:None | ||||||||

| Mr. Jacobs brings to the Board: | ||||||||

In-depth knowledge of the ■ | ||||||||

■ | ||||||||

| ||||||||

| | | | | | | | |

| | | | 14 | | | | ©2021 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

Gena | Independent Director since 2016 | |||||

Age: 59 | ||||||

| ||||||

| ||||||

Board Committees: ■ Member of ■ Member of Acquisition Committee | ||||||

Other Public Company Boards: None | ||||||

| ||||||

| Ms. Ashe brings to the Board: | ||||||

More than two decades of valuable legal experience with public and private companies, ■ | ||||||

| ||||||

| Marlene Colucci | Independent Director since 2019 | |||||

Age: 58 | ||||||

Ms. Colucci has served as a director of the company since February 7, 2019. She has served as the executive director of The Business Council in Washington, D.C. since July 2013. Previously, from September 2005 to June 2013, she was executive vice president of public policy for the American Hotel & Lodging Association. From September 2003 to June 2005, she served in the White House as special assistant to President George W. Bush in the Office of Domestic Policy. In this role, she developed labor, transportation and postal reform policies and advised the president and his staff on related matters. Earlier, Ms. Colucci served as deputy assistant secretary with the U.S. Department of Labor's Office of Congressional and Intergovernmental Affairs. Her law career includes more than 12 years with the firm of Akin Gump Strauss Hauer & Feld LLP, where she served as senior counsel. She holds a juris doctorate degree from the Georgetown University Law Center. | ||||||

| Board Committees: ■ Member of Compensation Committee ■ Member of Acquisition Committee | ||||||

Other Public Company Boards: None | ||||||

■ Significant experience with public policy development, including labor and transportation policy, from over two decades of relevant government and private sector experience; and ■ Meaningful perspectives on matters of corporate governance and business operations from her tenure leading the premier association of chief executive officers of the world's most important business enterprises. | ||||||

| | | | | | | | |

| | | | 15 | | | | ©2021 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

| AnnaMaria DeSalva |

| Independent Director since 2017 | ||||||||

Age: 52 |

| Vice Chairman since 2019 | ||||||||

| ||||||||||

| Board Committees: | ■ Chairman of Nominating, Corporate Governance and Sustainability Committee | |||||||||

| ||||||||||

Ms. DeSalva brings to the Board: ■ | ||||||||||

■ Significant experience in | ||||||||||

| ||||||||||

| Michael Jesselson |

| Independent Director since 2011 | ||||||

Age: 69 | Lead Independent Director since 2016 | |||||||

Mr. Jesselson has served as a director of the company since September 2, 2011 and as lead independent director since March 20, 2016. He has | ||||||||

Board Committees: ■ Member of Audit Committee ■ Member of Compensation Committee ■ Member of Nominating, Corporate Governance and Sustainability Committee | ||||||||

Other Public Company Boards: Ascendant Digital Acquisition Corp. (NYSE: ACND) | ||||||||

| ||||||||

| ||||||||

| ||||||||

Mr. Jesselson brings to the Board: ■ | ||||||||

■ | ||||||||

| ||||||||

| | | | | | | | |

| | | | 16 | | | | ©2021 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

| Adrian Kingshott |

| Independent Director since 2011 | ||||||

Age: 61 | ||||||||

| ||||||||

| Board Committees: | ||||||||

Chairman of | ||||||||

| ||||||||

| ||||||||

| ||||||||

| Mr. Kingshott brings to the Board: | ||||||||

More than 25 years of experience in the investment banking and investment management industries; and ■ | ||||||||

| ||||||||

| Jason Papastavrou, Ph.D. | ||||||||||||

| Independent Director since 2011 | |||||||

Age: 58 | ||||||||

| ||||||||

| ||||||||

| Board Committees: ■ Chairman of Compensation Committee ■ Member of Audit Committee ■ Member of Nominating, Corporate Governance and Sustainability Committee | ||||||||

Other Public Company Boards: None | ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| Dr. Papastavrou brings to the Board: | ||||||||

Financial expertise related to his qualifications as an ■ | ||||||||

| ||||||||

| | | | | | | | |

| | | | 17 | | | | ©2021 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

| Oren Shaffer |

| Independent Director since 2011 | ||||||

Age: 78 | ||||||||

| ||||||||

Board Committees: ■ | ||||||||

| ||||||||

| ||||||||

| Mr. Shaffer brings to the Board: ■ | ||||||||

■ | ||||||||

■ | ||||||||

| ||||||||

Summary of Qualifications and Experience of Director Nominees

|

|

|

|

|

|

|

| | |||||||

| | | | 18 | | | | ©2021 XPO Logistics, Inc. | |||||||

| | | | | | | | | |||||||

|

| | | | | | | |

SUMMARY OF QUALIFICATIONS AND EXPERIENCE OF DIRECTOR NOMINEES |

| | | | | | | | | ||||||

| | | | 19 | | | | ©2021 XPO Logistics, Inc. | ||||||

| | | | | | | | | ||||||

| | | | | | | | |||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

|

| |

Role of the Board and Board Leadership Structure

ROLE OF THE BOARD AND BOARD LEADERSHIP STRUCTURE |

Our business and affairs are managed under the direction of our Board of Directors, which is our company’scompany's ultimate decision-making body, except with respect to those matters reserved to our stockholders. Our Board’sBoard's primary responsibility is to seek to maximize long-term stockholder value. Our Board establishes our overall corporate policies, selects and evaluates our senior management team, which is charged with the conduct of our business, monitors the performance of our company and management, and provides advice and counsel to management. In fulfilling the Board’sBoard's responsibilities, our directors have full access to our management, internal and external auditors and outside advisors.

Furthermore, our Board of Directors is committed to independent Board oversight. Our current Board leadership structure includes an executive Chairmanchairman as well as a lead independent director.director and an independent vice chairman. The positions of Chairmanchairman of the Board and Chief Executive Officerchief executive officer are both currently held by Mr. Jacobs. Our Board believes that this combination of roles is appropriate because the structure enables decisive leadership and ensures clear accountability in the context of strong Board practices and a Board culture that facilitates independent oversight. On December 2, 2020, Mr. Jacobs underscored his commitment to maximizing shareholder value when XPO announced that the Board had authorized company management to pursue a plan to spin off XPO's logistics business into an independent, publicly-traded company. The planned spinoff demonstrates Mr. Jacobs' ability to focus on creating value for stockholders and also remain intensely committed to the satisfaction of our customers and employees. Our Board believes the dual roles function well for our company based on our current strategy, governance and ownership structure.

In addition,To further strengthen its independent decision-making, our Board of Directors has approved a set of Corporate Governance Guidelines (the “Guidelines”"Guidelines"), which provide that the independent directors may appoint a lead independent director who presides over executive sessions of the independent directors, and who shall serve a term of at least one year. On March 20, 2016, the independent directors appointed Mr. Jesselson to serve as lead independent director. The position of lead independent director has been structured to serve as an effective balance to the dual roles served by Mr. Jacobs. The lead independent director presidesJacobs, and to include, among other duties: (i) presiding at all meetings of the Board of Directors at which the Chairmanchairman is not present and presidespresent; (ii) presiding at all executive sessions of the independent directors. The Guidelines require that the independent directors, meetwhich must take place at least once a year without members of management present,present; and the lead independent director is empowered to call(iii) calling additional meetings of the independent directors as necessary. In practice, in 2017,2020, our independent directors met in executive sessions much more frequently. The lead independent director also serves as a liaison between the Chairmanchairman and the independent directors. Together with the Chairman,chairman, the lead independent director develops and approves Board meeting agendas, meeting schedules and meeting materials to be distributed to our Board of Directors in order to assureensure sufficient time for informed discussion of issues. The lead independent director is also available to meet with significant stockholders as required. On March 20, 2016, the independent directors appointed Mr. Jesselson to serve as lead independent director.

In addition, on February 7, 2019, the Board established an independent vice chairman position as part of its ongoing commitment to strong corporate governance. The position of vice chairman is defined as an independent director with authorities and duties that include, among others: (i) presiding at meetings of the Board where the chairman and lead independent director are not present; (ii) assisting the chairman, when appropriate, in carrying out his or her duties; (iii) assisting the lead independent director, when appropriate, in carrying out his or her duties; and required.(iv) such other duties, responsibilities and assistance as the Board or the chairman may determine. Ms. DeSalva was appointed to serve as vice chairman on February 7, 2019, to provide support on key governance matters and stockholder engagement to the chairman, lead independent director and the Board.

Further information regarding the positionpositions of lead independent director and vice chairman is set forth in the Guidelines. The Guidelines are available on the company’scompany's corporate website atwww.xpo.com under the Investors tab.

Our Board of Directors held seven20 meetings during 2017. In 2017, each2020. Each person currently serving as a director attended at least 86%93% of the Board meetings, as well as the meetings of our Board of Directors and any Board committeecommittee(s) on which he or she served. In addition, during 2020, our Board of Directors also acted five times during 2017twice via unanimous written consent.

Our directors are expected to attend theour annual meeting.meetings. Any director who is unable to attend the annual meeting is expected to notify the Chairmanchairman of the Board in advance of the annual meeting. Each person who was thenmeeting date. All of our directors serving as a directorand standing for re-election attended the 2017 annual meeting2020 Annual Meeting of stockholders.Stockholders.

BOARD RISK OVERSIGHT |

Our Board of Directors provides overall risk oversight, with a focus on the most significant risks facing our company. In addition, the Board is responsible for ensuring that appropriate crisis management and business continuity plans are in place. The management of the risks that we face in the conduct ofto our business, isand the execution of contingency plans, are primarily the responsibility of our senior management team.

| | | | | | | | |

| | | | 20 | | | | ©2021 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

Our Board and senior management team periodically reviews with our Board of Directors any significant risks facing our company. Ourregularly discuss the company's business strategy, operations, policies, controls, and prospects, are regularly discussed by our Board of Directors and management team, including discussions as to current and potential risks andrisks. These discussions include approaches for assessing, monitoring, mitigating and controlling risk exposure. OurThe Board of Directors has delegated responsibility for the oversight of specific risks special committees as follows:

- ■

- Audit Committee. The Audit Committee oversees the policies that govern the process by which our exposure to risk is assessed and managed by management. In that role, the Audit Committee discusses major financial risk exposures with our management and discusses the steps that management has taken to monitor and control these exposures. Additionally, the Audit Committee is responsible for reviewing risks arising from related party transactions involving our company, and for overseeing our companywide Code of Business Ethics and overall compliance with legal and regulatory requirements.

- ■

- Compensation Committee. The Compensation Committee monitors the risks associated with our compensation philosophy and programs. The Committee ensures that the company's compensation structure strikes an appropriate balance in motivating our senior executives to deliver long-term results for the company's stockholders, while simultaneously holding our senior leadership team accountable.

- ■

- Nominating, Corporate Governance and Sustainability Committee. The Nominating, Corporate Governance and Sustainability Committee oversees risks related to our governance structure and processes, as well as risks associated with the company's corporate sustainability practices and reporting.

- ■

- Acquisition Committee. The Acquisition Committee oversees risks related to the

committeesexecution of our acquisition strategy.

To navigate the evolving COVID-19 pandemic, we assembled a cross-disciplinary crisis management team that includes all of our executive officers. This team oversees the management of COVID-19 risks to employee health and safety, which is paramount, and to our business operations and financial condition. Board members receive frequent updates from the crisis management team at formal Board meetings and through informal direct participation in crisis management team meetings. Among other topics, these updates cover the measures we are taking to address the risk of transmission of COVID-19 among our employees and the wider communities in which we operate, as follows:well as our COVID-related communications with employees, customers and other company stakeholders.

In addition, ourthe Board of Directors periodically holds special board sessions to discuss and analyzeevaluate topical trends identified as significant risks or items of strategic interest, such as human capitalresources management, information technology and cyber security. OurThe Board of Directors is committed to ensuring that our company has the focus, resources and infrastructure necessary to appropriately address suchall significant risks.

Committees of the Board and Committee Membership

COMMITTEES OF THE BOARD AND COMMITTEE MEMBERSHIP |

Our Board of Directors has established four separately designated, standing committees to assist the Board in discharging its responsibilities: the Audit Committee, the Compensation Committee, the Nominating, and Corporate Governance and Sustainability Committee, and the Acquisition Committee. Our Board of Directors may eliminate or create additional committees as it deems appropriate. Each of our Board Committees havethese committees has a written charterscharter that are in compliancecomplies with applicable SEC rules and with the NYSE Listed Company Manual. These charters are available atwww.xpo.com. You may obtain a printed copy of any of these charters, without charge, by sending a request to: Investor Relations,Secretary, XPO Logistics, Inc., Five American Lane, Greenwich, Connecticut 06831.